MEDIA ROOTS — Pacifica Radio’s Guns and Butter have faithfully broadcast another potent weekly instalment of compelling discussions from the radical economics summit in Rimini, Italy produced by journalist Paolo Barnard: Summit Modern Money Theory 2012. Media Roots previously transcribed and featured the first, second, third, and fourth consecutive Guns and Butter broadcasts on the MMT Summit. Here we present the most recent coverage of this important and inspiring international economic summit featuring academic Dr. William K. Black, author of The Best Way to Rob a Bank Is to Own One.

MEDIA ROOTS — Pacifica Radio’s Guns and Butter have faithfully broadcast another potent weekly instalment of compelling discussions from the radical economics summit in Rimini, Italy produced by journalist Paolo Barnard: Summit Modern Money Theory 2012. Media Roots previously transcribed and featured the first, second, third, and fourth consecutive Guns and Butter broadcasts on the MMT Summit. Here we present the most recent coverage of this important and inspiring international economic summit featuring academic Dr. William K. Black, author of The Best Way to Rob a Bank Is to Own One.

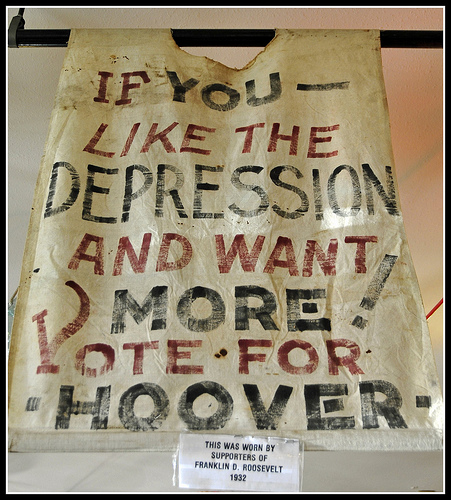

It’s essential to understand, at least, the basics of how the ruling-class widens inequality. It’s equally important to understand our role in perpetuating that widening inequality by supporting their corrupt political parties, the Democrat and Republican parties, and their counterparts abroad, for which no amount of token reformers, such as Dennis Kucinich or Paul Wellstone or Barbara Lee or you name it, could compensate because corporate funding isn’t intended to benefit the working-class. Dr. Black discusses many economics taboos never mentioned. Similarly, we must acknowledge political taboos never mentioned, such as our rigged two-party system. The days of New Deal Democrats are long gone. It’s high time for expanding beyond U.S.A.’s monopolised two-party dictatorship, which undergirds the vast fraud Dr. Black discusses, as well as virtually every other single-issue, which atomised activists toil against. As U.S.A. faces the masochistic prospect of electing another pro-1% Republican or re-electing the pro-1% Democrat Obama, we bear in mind the role of political parties and their principles, or lack thereof, and our atrophied votes for the least worst, rather than the best possible. (Transcript below.)

Messina

***

GUNS AND BUTTER — “And here’s the key question: How many of you are bankers? Not many, right? How much brains does it take to make a bad loan? I think we could all do that. So, all the mediocre bankers have no way to make money with honest competition. But they have a sure thing, if they’re willing to follow the fraud recipe.” —William K. Black

“I’m Bonnie Faulkner. Today on Guns and Butter: William K. Black. Today’s show: ‘Formula For Fraud.’ William Black is Associate Professor of Law and Economics at the University of Missouri, Kansas City. He is a lawyer, academic, and former bank regulator and author of The Best Way to Rob a Bank is to Own One: How Corporate Executives and Politicians Looted the S&L Industry.

“According to William Black, the current crisis is 70 times larger than the Collapse of the Savings and Loan Industry in the late 1980s. Today’s programme includes two of Bill Black’s presentations on Saturday, February 25th, [2012] in Rimini, Italy at the first Italian grassroots economic Summit on Modern Money Theory produced by Italian journalist Paolo Barnard, which featured speakers Stephanie Kelton, William Black, Marshall Auerback, Michael Hudson, and Alain Parguez.

“In today’s show, Black deconstructs the elements, that constitute the recipe for fraud.”

Dr. William K. Black (c. 2:05): “It’s difficult to follow such a raging optimist. [Applause] But I can assure you, it’s actually far worse than they say. First, there are no ‘technocrats,’ especially the ‘genius’ technocrats. I suggest a new rule of thumb for judging a ‘genius technocrat.’ They have to be right at least two out of ten times. And there’s not a single economist in Europe, who calls himself a technocrat, that could do the equivalent of making two penalty kicks out of ten. So, I’m going to pick up on some of the things, that Michael [Hudson] has talked about. He quoted Balzac’s famous phrase that behind every fortune lies a great scandal. And I’m going to explain how that works. So, you will now learn how to steal €10 billion euros. [Applause] The purpose of this is not so that you will steal €10 billion euros. The purpose is so that you can be an intelligent lion because they feed on sheep.

(c. 3:40) “We’ve been asked to do our talks in four parts. So, unlike Gaul, my speech is divided in four parts. This talk will be about why we suffer recurrent, intensifying, financial crises. Then, I’ll explain how theoclassical economic dogma produces these disasters. The third part will be to explain why our response to the crisis has made it worse. And I, actually, will end on an optimistic note. The fourth part is how we have succeeded in some places at some times and why you can do the same.

(c. 4:29) “Part one sounds like one question: Why do we have recurrent, intensifying, financial crises? But it’s really two questions. The first one asks: What is the cause of these crises? The second one says: Well, wait a minute. We keep on suffering crises. Why don’t we learn the right lessons from these crises? So, part one will focus on what caused the crises.

(c. 5:05) “Part two will focus on why ideology prevents us from learning the right lessons.

“Santayana’s famous phrase, of course, is that those that forget the mistakes of the past are condemned to repeat them. But, even if we remember the mistakes we’ve made, the new policy we pick could be another mistake. So, part three discusses that, in part.

“But part four says the real tragedy is when you forget the successes of the past, when you have something that you know works and that you refuse to use. Because, as Michael [Hudson] said, there’s not an economics textbook in the world, that warns you that elite CEOs often become wealthy through fraud. And there is a primitive, tribal, taboo in economics in English against using the five-letter eff-word—fraud. When I go and talk to groups of economists, who are traditional, I start out the meeting by asking them each to say out loud the word fraud. You can’t believe how difficult it is for them, even, to utter the word.

(c. 6:42) “So, as I said, the lessons of success, it’s a real tragedy to forget them. And I’m going to quote from George Akerlof and Paul Romer’s famous article, or, at least, an article, that should be famous where the title says it all: ‘Looting: The Economic Underworld of Bankruptcy for Profit.’ So, the bank fails or, in the modern era, is ‘bailed‘ out, but the CEO walks away wealthy. And this is what Akerlof and Romer wrote about 20 years ago:

“‘Neither the public, nor economists foresaw that savings and loan deregulation was bound to produce looting, nor, unaware of the concept, could they have known how serious it would be. Thus, the regulators in the field who understood what was happening from the beginning found lukewarm support, at best, for their cause. Now, we know better. If we learn from experience, history need not repeat itself.’

(c. 8:22) “George Akerlof was awarded the Nobel Prize in Economics in 2001. So, you might think economists would pay attention. You might think, since this article was written nearly 20 years ago, that the textbooks would mention fraud and looting. They don’t just ignore everyone here. They ignore Nobel Prize winners in Economics.

“So, what, again, was this lesson? It was the regulators in the field, the little people, not the fancy people, who understood from the beginning that deregulation would lead to massive looting. And it was the economists, that ignored them. And after we had proven that it was fraud, after we had sent over a thousand elite bankers and their cronies to prison, after a Nobel Prize winner warned about it, after all those things, they ignored it and produced crisis after crisis, including the one we experience now.

(c. 9:59) “So, what did we know out of that savings and loan crisis, that was widely described at the time as the worst financial scandal in U.S. history? And we have a history rich in scandal. Here is what the national commission, that investigated the causes of the crisis reported:

“‘The typical large failure [grew] at an extremely rapid rate, achieving high concentrations of assets in risky ventures… [E]very accounting trick available was used… Evidence of fraud was invariably present, as was the ability of the operators to ‘milk’ the organisation.’

(c. 11:04) “That means to loot the organisation. But, speaking of milk, [Applause] the frauds I’m describing are in no way limited to the Unites States; they exist in every country. And they are common enough to explain, and they are old enough to explain, what Balzac was saying because many of the wealthy become rich through precisely the scandals, the fraud, I will describe.

“In criminology, we call them financial super predators when we’re being lyrical. When we’re writing journals, we call them ‘control frauds,’ which is boring. Control fraud occurs when the person who controls a seemingly legitimate entity, like Parmalat, uses it as a weapon to defraud. And they can often use this weapon with impunity. In finance, accounting is the weapon of choice. And these accounting frauds cause greater losses than all other property crimes combined; yet, economics, again, never talks about it. Worse, when many of these frauds occur in the same area, they hyperinflate financial bubbles, which is what causes financial crises and mass unemployment. It makes the CEOs wealthy, produces Balzac scandals, and destroys democracy.

(c. 13:10) “In criminology, we talk about criminogenic environments, long words, simple concept. When the incentives are extremely perverse, you will get widespread fraud. So, what makes for perverse incentives? The ability to steal a lot of money and not go to prison and not having to live in disgrace. In practice, that means, in English, the three Ds: deregulation, desupervision, and de facto decriminalisation. Deregulation: You get rid of the rules. Desupervision: Any rules, that remain, you don’t enforce. Decriminalisation: Even if you sometimes sue them and get a fine, you don’t put them in prison. So, that’s the first area—deregulation.

(c. 14:20) “The second area is executive compensation. And what is ideal for accounting fraud? Really high pay based on short-term-reported income with no way to claw it back, even when it proves to be a lie. Those are the most important, but it’s also good, if your assets don’t have a readily verifiable market-value ‘cos then it’s easy to inflate the asset prices and it’s easy to hide the real losses. And, if you want a true epidemic of fraud, if entry into the industry is very easy, then you’ll get much more fraud.”

Bonnie Faulkner (c. 15:15): “You’re listening to lawyer, academic, author, and former bank regulator William K. Black. Today’s show: ‘Formula for Fraud.’ I’m Bonnie Faulkner. This is Guns and Butter.”

Dr. William K. Black: “So, this is what you were waiting for, at least from me. This is the recipe, only four ingredients, that bankers in many parts of the world use to become billionaires. And, again, it’s one that Akerlof and Romer agreed with. So, first ingredient: grow massively. Two: by making really, really crappy loans, but at a higher interest rate. Third ingredient: extreme leverage—that just means a lot of corporate debt. Fourth ingredient: set aside virtually no loss reserves for the massive losses that will be coming. By the way, in Europe, this last ingredient is mandated by international accounting rules, which are incredibly fraud-friendly. And everybody knows that—in accounting—and nobody has changed it. If you do these four things, you are mathematically guaranteed to report record short-term income. This is why Akerlof and Romer referred to it as a sure thing—it’s guaranteed.

(c. 17:10) “There are actually three sure things. The bank will report record profits. The profits, of course, are fictional. The CEO will promptly become wealthy and, down the road, the bank will suffer catastrophic losses. Again, if many banks do this, you will hyperinflate a bubble. This recipe helps explain why bankers hate markets, why bankers hate capitalism, why they hate anything like an effective market.

“So here’s a thought exercise: What if you were a CEO of a bank and you wanted to grow exceptionally rapidly? The first ingredient to the fraud recipe, that means 50% a year. And that’s realistic; that’s what the banks in Iceland, that’s what many of the banks in Europe—continental Europe—and the US also did. How would you do that if you were honest? You’re in a market that’s competitive. The only way to grow that rapidly is to charge far less money—a lower interest rate—for your loans. But if they’re a real market what would your competitors do? They would match your price reduction. You wouldn’t end up making any more loans; and all the banks would be loaning at a lower interest rate. So, here’s the question? Is that a good way to make money as a bank? It’s a terrible thing for a bank, right? So, all the bankers would lose. And that’s why they hate markets. And that’s why banks are the biggest proponents of crony capitalism and the leaders worldwide in crony capitalism.

(c. 19:26) “And that leads us to a discussion of why bad loans are so perfect for bank fraud; you can charge a much higher rate to people who can’t get loans because they can’t repay the loans. And there are millions, tens of millions, of such people. So, you can grow very rapidly. You can charge a higher interest rate. If your competitors do the same thing, it’s actually ‘good’ for you because it hyperinflates the bubble. And the bad loans, you just refinance them and you hide the losses for many more years.

(c. 20:22) “So, the CEO takes no risk; all of this is a sure thing. And here’s the key question: How many of you are bankers? Not many, right? How much brains does it take to make a bad loan? I think we could all do that. So, all the mediocre bankers have no way to make money with honest competition. But they have a sure thing, if they’re willing to follow the fraud recipe. I’m now gonna quote from the person, the economist [James Pierce, NCFIRRE’s Executive Director], who led the national investigation of the savings and loan crisis. And he called this dynamic I’ve just explained, ‘the ultimate perverse incentive.’ So, this is what he said:

(c. 21:28) “‘Accounting abuses also provided the ultimate perverse incentive: it paid to seek out bad loans because only those who had no intention of repaying would be willing to offer the high loan fees and interest required for the best looting. It was rational for operators’—that’s CEOs—‘to drive their banks ever deeper into insolvency, as they looted them.’

(c. 22:12) “That is how crazy a world that theoclassical economics has built, where the best way, the surest way, to become wealthy, as a bank CEO, is to make the worst possible loans. And to make so many bad loans, they have to gut the underwriting process. Underwriting is what an honest bank does to make sure that it’s going to get repaid. But, if you want to make bad loans, you have to get rid of your effective underwriting. So, this is the key, if you get rid of underwriting. We already established you’re not bankers.

“So, imagine all of you run Competent Honest Bank and you do underwriting. And you can tell can tell high-risk and low-risk borrowers. Low risk borrowers you charge 10%. High-risk borrowers you charge 20%. I run Bill’s Incompetent Bank, I can’t tell risk. So, I charge everybody 15%. Which borrowers come to me? Only the absolute worst borrowers. No good borrower would come because they could borrow at your bank at 10%. So, this is not like a usual risk. In economics, we call this adverse selection. And it means that a bank, that makes loans this way must lose vast amounts of money. No honest banker would operate this way. And the banks, that engage in these frauds, also create criminogenic environments, themselves, to recruit fraud allies. For example, the people, that value homes. If they won’t inflate the value, the dishonest banks won’t use them. Do they need to corrupt every person that values homes? No. 5% of the profession would be fine. They just send all their business to the corrupt—we call them—appraisers in America. And this is called a Gresham’s Dynamic; and it means that cheaters prosper and bad ethics drives good ethics out of the marketplace.

(c. 25:18) “Well, what about compensation? In [the United States of] America, the largest corporations, the largest 100, created a group to lobby, called the Business Roundtable. And you remember our Enron-era frauds, early 2000s? Well, they got embarrassed. And, so, they appointed a task force to look at the frauds. And they named a particular CEO as head of their task force; and he was asked by Business Week, why do we have all these frauds? This is the answer he gave:

“‘Don’t just say: ‘If you hit this revenue number, your bonus is going to be this.’ It sets up an incentive that’s overwhelming. You wave enough money in front of people; and good people will do bad things.’

(c. 26:28) “And that was Franklin Raines, the head of Fannie Mae, which is now insolvent by about $500 billion dollars. How did Frank Raines know about this perverse incentive? Because he used it at Fannie Mae to produce the frauds, that made him wealthy.

“How about Ireland? This is a report by a Scandinavian banker hired to do an investigation, not a real investigation, of course. He reported:

“‘Bonus targets, that were intended to be demanding through the pursuit of sound policies and prudent spread of risk were easily achieved through volume lending to the property sector.’

(c. 27:25) “Now, that requires a translation, not because it’s written in English, but because it’s written to be not understood. So, what is he really saying? The bank CEO sets a target for income, that is huge—three times the current income. How can you triple income safely? Wow, if somebody could really do that safely, we’d be happy to pay them a very big bonus, right? But what does he say?

“You don’t have to do it safely. And it isn’t hard. You just follow the fraud formula, the recipe, and it’s a sure thing. It’s easily achieved.

“What’s wrong with his sentence, though?

“He says the targets were intended to be difficult, demanding. And they were intended to be met through prudent lending.

(c. 28:34) “Seriously, you think that? The CEO is deciding how much money he is going to make. Do you think he intended a demanding target or a target that was easily achieved and would make him wealthy?

“So, I will end on this. We need a coast guard for our banks. We can no longer allow CEOs to desert their posts after running their banks aground and causing such great destruction. The cruise ship’s captain’s career is over. But the elite bank CEOs, that destroyed the global economy remain wealthy, powerful, and famous because they looted. They were ‘bailed’ out. They did not leave in a lifeboat in the dark of night. They left in their yachts, yachts that the governments paid for. And no official anywhere in the world has demanded of those bank CEOs who deserted their vessels […] [Applause] Grazie.”

Bonnie Faulkner (c.30:30): “You’re listening to lawyer, academic, author, and former bank regulator William K. Black. Today’s show: ‘Formula for Fraud.’ I’m Bonnie Faulkner. This is Guns and Butter.”

Dr. William K. Black: “Someone called on the Black Plague? I’m here. [Laughter, Applause]

“In this part two, I’m going to talk about why we have recurrent, intensifying crises, why we don’t learn the right lessons from our past crises. And then we’re going to discover something that, of course, you’ve been hearing. The dominant economists are truly terrible at one thing. They are terrible at economics. But occasionally they go beyond economics and they are abysmal on ethics. And they are the leading opponents and dangers to democracy throughout the EU, in particular, but in America as well.

(c. 31:40) “Economists tell us they want to be judged on their predictive ability. We welcome their admission because their record in prediction is pitiful. But, of course, it is precisely the fact that they’ve been wrong about everything important for three decades, that makes them unwilling to admit their error and evermore insistent on continuing their worst policy advice.

(c. 32:12) “As I said economics is particularly awful when it gets into the concept of morality. In my first talk, I read you a quotation from the economist who conducted the study of the savings and loan crisis. And he pointed out that it was ‘rational’ for looters to make bad loans. Well, here is the reaction of one economist, Greg Mankiw, to hearing the work of that national commission and of that Nobel Prize winner-to-be, George Akerlof. He listened to their story and he said—and this is not an off-hand comment; he was the official discussant; he had the paper a week in advance; he thought about these remarks—he said:

“‘[…] it would be irrational for savings and loans [CEOs] not to loot.’

“So, note that he goes from simply a statement about how you maximise fraud by making bad loans to the ethical proposition that if it would be rational action, it must be the appropriate action, even though the rational action is to defraud.

(c. 33:40) “Now, there’s a very interesting book called Moral Markets, that had the unfortunate timing to come out in 2008 because it is a triumphal book about capitalism and about how capitalism makes markets more moral. But even it contains this statement:

“‘Homo economicus is a sociopath. Homo economicus is what happens if people behave the way economists predict that they will behave.’

“And these scholars, who love capitalism, said: if you do that, you will create a nation of sociopaths.

“Greg Mankiw was not a random economist. [Then-]President Bush made him Chairman of the President’s Council of Economic Advisers, the most prominent economic position in America, after he had said these things.

(c. 34:48) “The next two gentlemen are the leading law and economics scholars on corporate law. And I’m quoting from their treatise in 1991; so, an entire generation of US lawyers have been taught this next phrase:

“‘A rule against fraud is not an essential or […] an important ingredient of securities markets.’

“The key economist there—who is not really an economist, he’s a lawyer—is Daniel Fischel. He worked for three of the worst control frauds, including the absolute worst savings and loan ‘control fraud,’ praised them as the best firms in America, and then wrote this two years later without ever admitting in his book that he had tried his theories in the real world and they had led him to praise the worst frauds. So, this is rank academic dishonesty on top of getting everything wrong. And what happened to Fischel after he got everything wrong? He was made Dean of the University of Chicago Law School, one of the most prominent academic positions in America.

(c. 36:15) “Alan Greenspan also worked for the worst fraud in the savings and loan crisis. Charles Keating’s Lincoln Savings. And he personally recruited, as a lobbyist for this worst fraud, the five [bipartisan] US Senators who would intervene with us to try and prevent us from taking enforcement action against the largest violation in the history of our agency because that violation was by Charles Keating and Lincoln Savings. And those five senators became known and ridiculed as the Keating Five. By the way, [Republican Senator] John McCain was one of those senators who met with us. [The other four were Democrats.]

“Alan Greenspan then wrote a letter saying we should allow Lincoln Savings to do these terrible investments because ‘they posed no foreseeable risk of loss to the federal insurance fund.’ Lincoln Savings proved to be the largest cost to the insurance fund. After he had gotten it as wrong, as it is possible to get something wrong, we made him Chairman of the Federal Reserve. So, here you have a record of we promote and honour, in economics, the people who get it spectacularly wrong, as long as they get it wrong for powerful banks, that are frauds.

(c. 37:59) “So, what did they predict? This is the short list. Neoclassical economists predicted, that because markets were efficient they were self-correcting, fraud was automatically excluded, and financial bubbles could not occur.

“They assured us that because of bankers’ interest in their reputations and auditors and appraisers, that they would never commit a fraud and never assist a fraud.

“They predicted that massive financial derivatives would stabilise the economic system.

“They told us, even when the bubble had reached proportions larger than any in the history of the world, that there was no housing bubble in the United States, that there was no housing bubble in Ireland, that there was no housing bubble in Japan, that there was no housing bubble in Spain.

“They told us that if we paid CEOs massive amounts of money based on short-term performance, that was fictional, it would align the interests of the CEO with the shareholders and the public and be the best possible thing.

(c. 39:30) “Every one of these predictions proved utterly false. Actually, every single one of these predictions had been falsified before the economists ever said them; and they did not change.

“What did they do back in the day? They looked at Europe. This is Cato, named, of course, after a famous Roman—a very conservative anti-think tank in the United States. Cato, in 2007, as Iceland was collapsing in massive fraud, said these words:

“‘Iceland’s economic renaissance is an impressive story. Supply-side reforms’—that means tax cuts—‘along with policies, such as privatisation and deregulation, have yielded predictable results.’

“Remember, we’re making predictions.

“‘Incomes are rising, unemployment is almost non-existent, and the government is collecting more revenue from a larger tax base.’

“So, they cut taxes, but overall tax revenue grows because the country is growing at a massive rate. Why? Because the big three banks in Iceland are all accounting control frauds. They are growing at an average rate of 50% every year. And by the time they collapse in 2008, they are ten times the GDP of Iceland. And they suffer 60% losses on their assets. That was their prediction of proof-positive that deregulation, low taxes, privatisation produce economic booms.

(c. 41:36) “They said something very similar about Ireland in an article entitled ‘It’s Not Luck‘:

“Ireland […] boasts the fourth highest gross domestic product per capita in the world. In the mid-1980s, Ireland was a backwater with an average income level 30% below that of the European Union. Today, Irish incomes are 40% above the EU average.

“‘Was this dramatic change the luck of the Irish? Not at all. It resulted from a series of hard-headed decisions that shifted Ireland from big government stagnation to free market growth.’

“And they wrote this in 2007, a year after the Irish bubble had popped and Ireland was going into freefall. And what are we being told now is the answer? Hard-headed decisions, that shift the governments from big government stagnation to free market growth. They have learned absolutely nothing from their past failed ‘predictions.’ In fact, Trichet came to Ireland in 2004 and said Ireland should be the model for nations joining the European Union.”

Bonnie Faulkner (c. 43:20): “You’re listening to lawyer, academic, author, and former bank regulator William K. Black. Today’s show: ‘Formula for Fraud.’ I’m Bonnie Faulkner. This is Guns and Butter.”

Dr. William K. Black: “But we have seen this movie many times before in many countries. We had seen it in the Savings and Loan Crisis. But then came the Enron-era Crisis and WorldCom. And I’ll focus on just one aspect. Again, we had accounting control fraud, that drove an immense crisis. But what people forget is that most of the world’s largest banks eagerly aided and abetted Enron’s frauds. They knew Enron was engaged in fraud; and they thought that was a good thing because they would get more deal flow, as we say, more volume. These frauds were documented extensively by investigations, hundreds of pages about it. Not a single one of the large conventional bankers were prosecuted. There was a prosecution about Merrill Lynch, which the courts obstructed. Indeed, the U.S. Supreme Court ruled that only the government could bring civil suits—against an enforcement action, of course—against banks, that aided and abetted fraud. Think of that! You could have indisputable proof that the bank had aided Enron, knowingly done so, caused you billions in losses, and you could not sue the bank. That’s how bad the law has become in the United States.

(c. 45:27) “So, that left us with, Will the government sue? Well, the Federal Reserve, we now know from recent testimony in front of the national commission, that investigated this current crisis, the leadership actively resisted bringing any action against the banks, even what we call a slap on the wrist. And it was only when the Securities and Exchange Commission took a slap on the wrist that the Federal Reserve was embarrassed into taking any action.

“We also know, from this extraordinary testimony by the long-time head of supervision at the Federal Reserve, that he was deeply disturbed by the fact that most of the largest banks in the world had aided Enron’s fraud. So, he put together a comprehensive briefing for the leadership of the Federal Reserve. At that meeting, the senior officials of the Federal Reserve and the senior economists of the Federal Reserve did not criticise Enron and they did not criticise the banks that aided Enron’s frauds. They were enraged at the supervisor. How dare he criticise banks? And this was the era—and continues, in the United States, to be the era—of reinventing government, which is a neoclassical, neoliberal, be soft on bankers.

“And I witnessed, personally, when our Washington staff came at a training conference and instructed us that we were to refer to banks as our clients. We were the regulators. And we were, not only, supposed to refer to them as clients, we were supposed to treat them as clients. Being a quiet type, I stood up and began protesting; and they simply shouted us down. [Applause]”

(c. 47:59) “So, this is occurring in 2001, 2002, 2003, 2004. At that point, Italy enters the picture. And Italy enters the picture because of Parmalat. And it enters the picture because, again, you have a massive accounting control fraud where the CEO is looting Parmalat and taking the money out of Italy to tax havens where he can hide it in a wave of special complex corporate forms designed to hide the fraud.

“And what does the Federal Reserve say about all of this? Well, first they brag about their ‘enforcement’ action. Note that they won’t name the large institutions:

“‘In these enforcement actions, certain large institutions were required to revise their risk management practices where examiners found failures by these institutions to identify those transactions, that presented heightened legal and reputational risk, particularly, in cases where transactions were used to facilitate a customer’s accounting or tax objective, that resulted in misrepresenting the company’s true financial condition to the public and regulators.’

(c. 49:42) “So, this is another passage that requires translation, not because it’s in English, but because it’s in gobbledygook. So, what are they really saying? First, they are bragging about an enforcement action, that they tried very hard not to bring and which was utterly useless. Second, note what their concern is. Their concern is “heightened legal and reputational risk.” They’re worried that when the bank aids Enron or Parmalat’s frauds they’ll get caught and then their reputation will suffer. They’re not worried about Enron’s shareholders. They’re not worried about the 12,000 Enron employees who lose their jobs. They’re not worried about Parma’s economy. None of that matters. They don’t even discuss it. And they’re not worried about morality. Call me old school, but I thought, when I was a regulator, if the banks I was regulating were engaged in fraud, first, my job was to stop it. Second, my job was to remove the CEO from office. Third, my job was to help prosecute him and put him in prison. And, fourth, my job was to sue him, so that he walked away with not a lira or a euro or a dollar. But all of that is gone. [Applause]

(c. 51:25) “But you know this because you have probably seen a gem of a film. And you know, probably, what Citicorp called this special vehicle it created to facilitate the looting of Parmalat. Somehow, I think this means black hole; that’s what they called it. And this is so wonderful. Citicorp eventually said it regretted one thing, calling it bucanero. The only thing it was honest about is the only thing it regretted. What it did to Italy in Parma, not so much.

(c. 52:15) “So, what did people find in this crisis? This is the National Commission Report on our crisis:

“‘We conclude widespread failures in financial regulation and supervision proved devastating to the stability of the nation’s financial markets. The sentries were not at their posts […] due to the widely-accepted faith in the self-correcting nature of the markets and the ability of financial institutions to effectively police themselves.’

“It specifically blames Greenspan and his deregulatory ideology. That could have helped to avoid a catastrophe.

(c. 53:05) “But those are words. Here is an image. The person—yes, this man—he is ‘Chainsaw Gilleran.’ That translates very well into Italian, I see. He was the head of the agency I used to work for. He is standing next to the three leading bank lobbyists in America and the guy who will be his successor. They are poised and posed over a pile of federal regulations. And, if that’s too subtle, they are tied up in red tape. And the message is: We will work with our clients, the banks, to destroy all regulation. And the reason we bring a chainsaw is to make clear that everything will be destroyed.

(c. 54:00) “Well, what about Europe? There was a conservative dissent to the conclusions I’ve just read. They claimed that deregulation could not have been a major cause of the crisis in America because the crisis also occurred in Europe. That’s all they said. They implicitly assumed that Europe must have been tough on bank regulation.

“I will conclude with these words from the report on the Irish Crisis. There were ‘generic weaknesses in EU regulation and supervision.‘ So, the dissent has it exactly wrong. They’re right; it’s important to look at Europe and the same causal mechanism—deregulation, desupervision, and this absurd executive compensation—swept Europe and America. And the economists got what they wanted and predicted it would be wonderful. It produced a catastrophe. [Applause]”

Bonnie Faulkner (c. 55:30): “You’ve been listening to William K. Black. Today’s show has been ‘Formula for Fraud.’ William Black is Associate Professor of Law and Economics at the University of Missouri, Kansas City. He is a lawyer, academic, and former bank regulator and the author of The Best Way to Rob a Bank is to Own One: How Corporate Executives and Politicians Looted the S&L Industry.

“Please visit the University of Missouri, Kansas City New Economic Perspectives blog at www.NewEconomicPerspectives.org. Visit the website for the first Italian Summit on Modern Money Theory at www.DemocraziaMMT.info.

Transcript by Felipe Messina for Media Roots and Guns and Butter

fm: Updated 27 MAR 2013 18:51 CST

***